The Internal Revenue Service (IRS) has recently released the 2024 cost-of-living adjustments, bringing several changes to the contribution limits applicable to retirement plans, including the popular 401(k) under secure act 2.0

These modifications pave the way for a more secure financial future. And the key updates 401k 2024 contribution limit irs

401k 2024 Contribution Limit IRS: Key Changes for 2024

1. Elective Deferrals for 401(k), 403(b), and eligible 457(b) plans

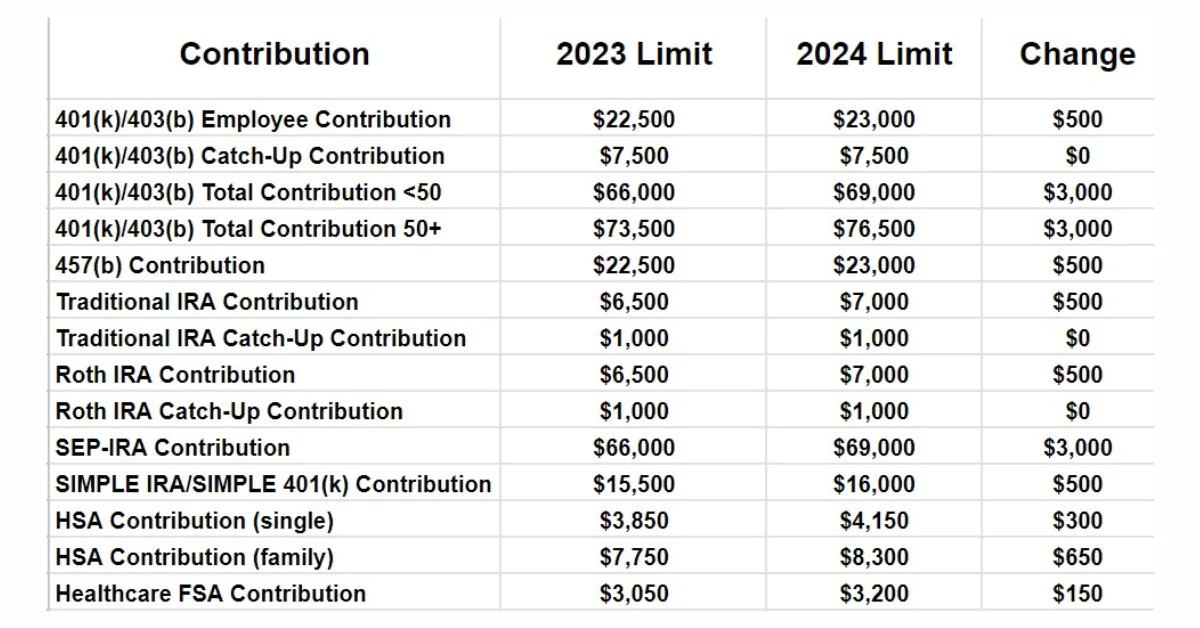

The IRS has raised the limit on elective deferrals for 401(k), 403(b), and eligible 457(b) plans to $23,000, allowing you to contribute more to your retirement fund.

2. Additional Catch-up Contributions

For participants aged 50 or older, the limit on additional catch-up contributions remains at $7,500.

This means that the maximum elective deferral contributions for these individuals in 2024 are $30,500, an opportunity to bolster your savings if you’re approaching retirement.

3. Annual Addition and Benefit Limits

In 2024, Code Section 415 has increased the annual addition limit to $69,000 for 401(k) and other defined contribution plans.

The annual benefit limit for defined benefit plans has also been raised to $275,000. These adjustments provide more flexibility in how you contribute to your retirement.

- Electric Car Battery Insurance Guide 2024

- How to Make Money with Bitcoin on Cash App

- Domino’s Free Pizza for Student Loans: A Slice of Relief

4. Compensation Limits

The annual compensation limit that qualified plans can consider under Code Section 417 has been increased to $345,000, allowing you to make the most of your entire income for your retirement security.

5. Highly Compensated Employees

For 2025, the threshold for highly compensated employees (HCEs) has been raised to $155,000, based on 2024 compensation. This change may affect your eligibility for certain benefits, so it’s important to be aware of it.

6. Key Employees

The threshold for “key employees” in top-heavy plans under Code Section 416(i)(1) has been increased to $220,000. If you fall into this category, this adjustment can have implications for your retirement planning strategy.

- 10 Best Binance Trading Bots in 2023: Pros and Cons Explained

- Make Money Online with User Testing: An Insider’s Guide

Traditional IRA Income limits 2024

The IRS allows taxpayers to deduct contributions to a traditional IRA under specific conditions. Here are the traditional ira income limits 2024:

- For individuals who are single and covered by a workplace retirement plan, the phase-out range has been raised to a level between $77,000 and $87,000, which is an increase from the previous range of $73,000 to $83,000.

- Likewise, for married couples who file jointly and where one spouse is contributing to an IRA and is covered by a workplace retirement plan, the phase-out range has seen an increase.

- It now falls between $123,000 and $143,000, up from the previous range of $116,000 to $136,000., up from between $116,000 and $136,000.

- If you’re an IRA contributor not covered by a workplace retirement plan but are married to someone who is covered, the phase-out range is increased to between $230,000 and $240,000, up from between $218,000 and $228,000.

- For a married individual filing a separate return who is covered by a workplace retirement plan, the phase-out range remains between $0 and $10,000.

Roth IRA Income limits 2024

Here are the roth ira income limits 2024:

- The income phase-out range for singles and heads of households is increased to between $146,000 and $161,000, up from between $138,000 and $153,000.

- In the case of married couples filing jointly, the income phase-out range has been extended to range between $230,000 and $240,000, representing an increase from the previous range of $218,000 to $228,000.

- The phase-out range for a married individual filing a separate return who makes contributions to a roth ira income limits remains between $0 and $10,000.

Credit Income Limits

The income limit for the Saver’s Credit, also known as the Retirement Savings Contributions Credit, has been raised. The current limit for the Saver’s Credit now rests at $76,500 for married couples filing jointly, showing an increase from the prior limit of $73,000.

For heads of household, the new limit is $57,375, up from the previous limit of $54,750. Additionally, singles and married individuals filing separately now have a limit of $38,250, marking an increase from the earlier limit.

SIMPLE Retirement Accounts

Individuals can now contribute up to $16,000 to their SIMPLE retirement accounts, an increase from the previous limit of $15,500. This change offers more room for savings.

Additional Changes Under SECURE Act 2.0

Further adjustments to retirement planning under secure act 2.0

- The limitation on premiums paid for a qualifying longevity annuity contract remains at $200,000 for 2024.

- An adjustment to the charitable distributions’ deductible limit is introduced, increasing to $105,000 for 2024.

- A deductible limit for a one-time election to treat a distribution from an individual retirement account made directly by the trustee to a split-interest entity has been raised to $53,000 for 2024.

Conclusion 401k 2024 contribution limit irs

In conclusion, the 401k 2024 contribution limit irs, along with the changes in traditional ira income limits and roth ira income limits, bring both challenges and opportunities to retirement planning. It’s crucial to understand how these adjustments affect your financial future and to make the necessary changes to maximize your retirement savings.

Moreover, the introduction of secure act 2.0 emphasizes the importance of staying informed about legislative changes that can influence your retirement plans.

By staying up to date with these limits and considering the implications of the secure act 2.0, you can make well-informed decisions and take proactive steps to secure a more comfortable and financially stable retirement.

Consulting with a financial advisor is always a wise choice to tailor your retirement strategy to your unique needs and goals.